IMPORTANT NEWS! All tax credit applications must be submitted online. There are no more “paper” applications. Follow this link to complete the online application to apply for a Charitable Contribution Credit.

Please email Tim McWilliams at tmcwilliams@bcvms.com or call him at 601.952.2422 for more information.

Watch a Step by Step Instruction Video

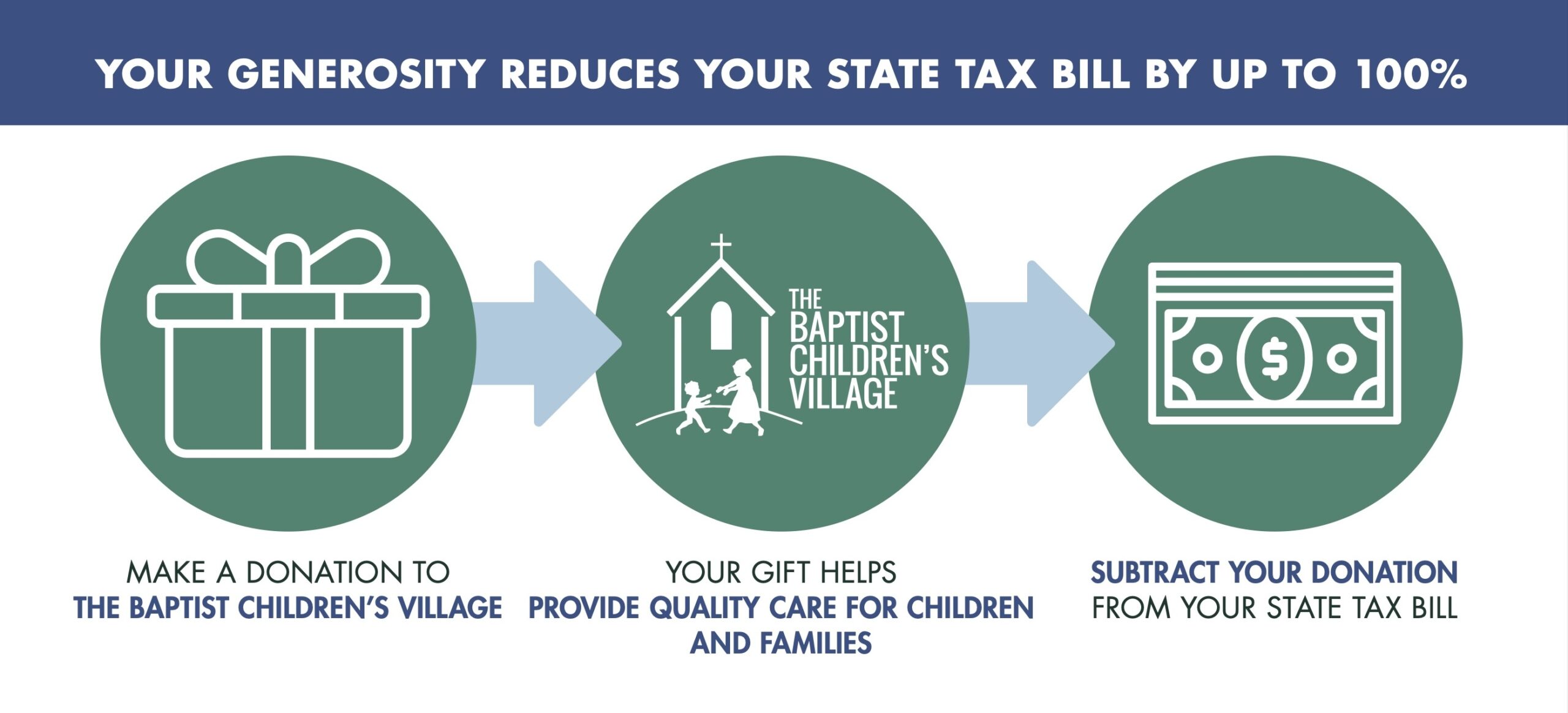

Reduce Your State Tax Liability: Designate a portion of what you owe the state of Mississippi to The Baptist Children’s Village.

Make a donation to Mississippi or a donation to the BCV

The Children’s Promise Act tax credit, passed by the legislature and signed by the governor in 2019, provides a dollar-for-dollar tax credit for donations to The BCV.

- State law provides donors with tax credits for their donations to Eligible Charitable Organizations (ECO), Qualified Foster Care Charitable Organizations (QFCCO), and Eligible Transitional Housing Organizations (ETHO).

- BCV is registered as an ECO, QFCCO, and ETHO.

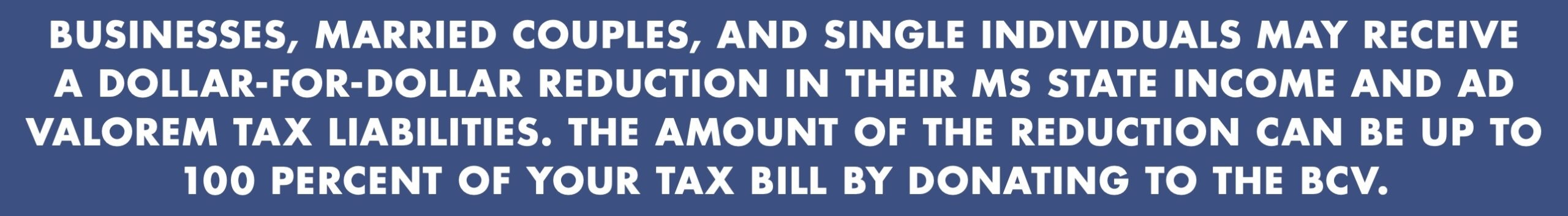

- A donor is a business entity (Corporation, Partnership, Limited Liability Company, and Sole Proprietorship), married couple, or single individual.

- Businesses and individuals may receive a dollar-for-dollar reduction in their state tax bill of up to 100 percent by donating to The Baptist Children’s Village.

Step by Step Watch Step by Step Video

Carry Forward: If you do not use the tax credit in one year, you do not lose it. You can take the credit over the next five (5) years immediately following your gift.

Other Limitations: Contributions cannot be used for other state charitable credits and cannot be used as a deduction for state income tax purposes

Please email Tim McWilliams at tmcwilliams@bcvms.com or call him at 601-952-2422 with any questions about how your gift will be utilized or about the process.

IMPORTANT: Always talk to your advisor before making any decisions regarding your tax liability.

Receive a tax credit while changing lives!